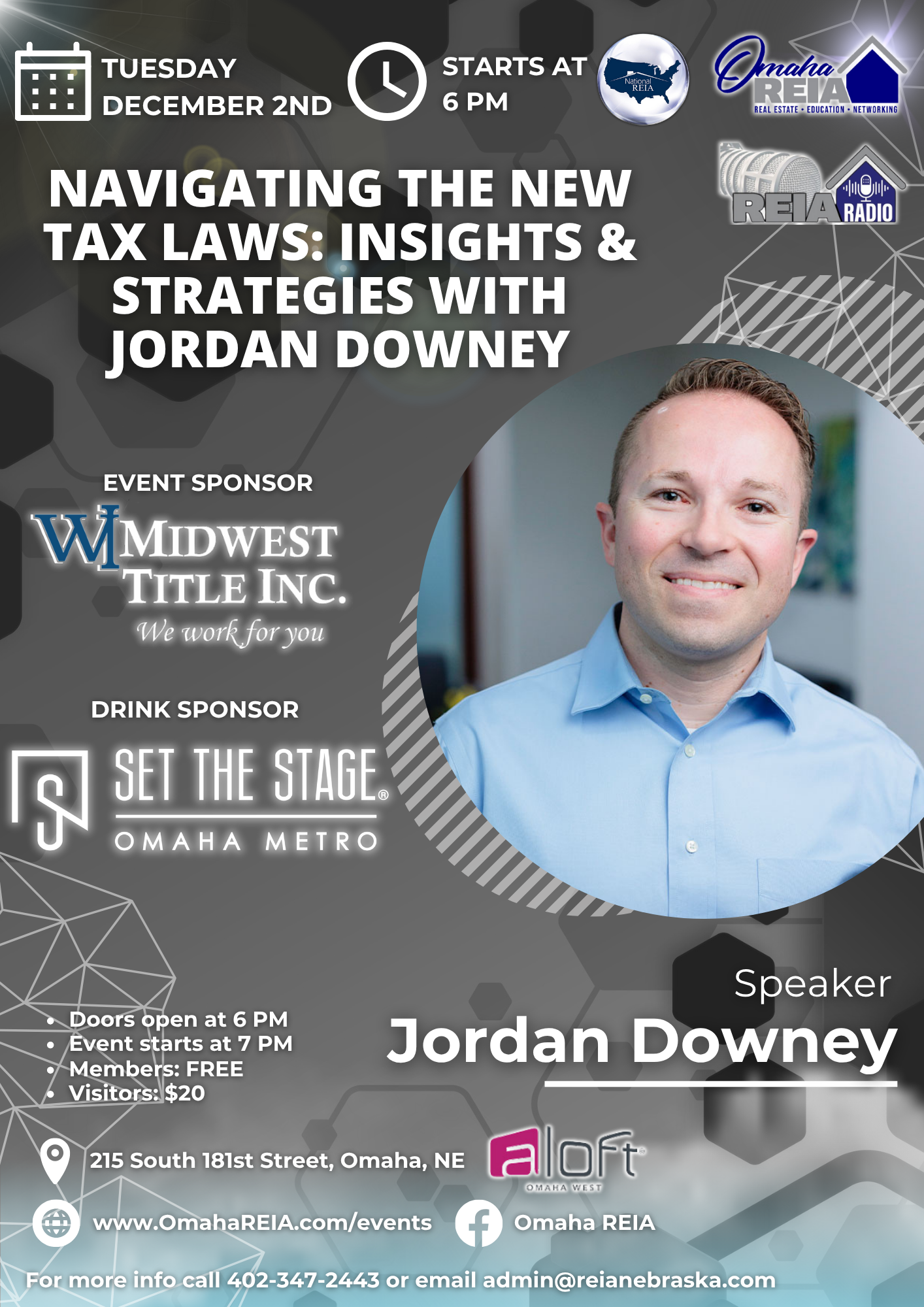

Navigating the New Tax Laws: Insights & Strategies with Jordan Downey

Tuesday, Dec 2, 2025 at 6:00 PM CSTAloft Omaha West

Event Details

As we approach the end of 2025, real estate investors, agents, and business owners are preparing for tax season under newly updated tax laws that could impact how you invest, structure deals, and maximize your returns. Are you ready?

Join Jordan Downey, Partner at Frankel, for a deep dive into the latest tax law changes and the best strategies to reduce tax burdens, optimize deductions, and structure your business for success.

What You’ll Learn:

2025 Tax Law Updates – What’s changed and how it affects real estate investors

Maximizing Deductions & Credits – Proven strategies to keep more of your hard-earned money

Tax-Advantaged Investing – Entity structures and planning tips for better tax efficiency

Common Pitfalls & Compliance Tips – Avoid costly mistakes before tax season

Proactive Planning for 2026 – Steps to get ahead before the new year

This power-packed session will provide actionable insights you can apply immediately, whether you're a seasoned investor or just starting your real estate journey.

Don’t wait until tax season to figure out the new rules—take control now and position yourself for financial success in 2026!

Register to Attend

Speaker(s):

Jordan Downey

CPA, MIST

Frankel, LLC